Western Nunavut gold mine project gains Chinese investor, project certificate

Chinese buy-in “a strong endorsement of the work completed to date at our world class Back River project”

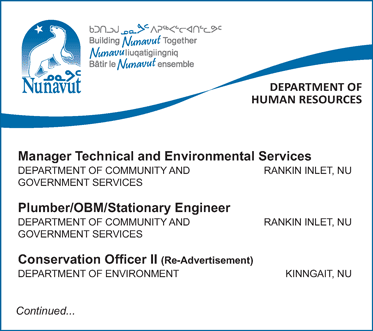

This map shows the location of Sabina Gold and Silver Corp.’s Back River gold mine project in western Nunavut. (FILE PHOTO)

A major Chinese gold producer has bought into Sabina Gold and Silver Corp.’s western Nunavut gold mine project.

Sabina said on Tuesday, Dec. 19, that the Zhaojin International Mining Co. Ltd. had agreed to purchase 24,930,000 common shares in the company.

That same day, the Vancouver-based junior mining company received its project certificate from the Nunavut Impact Review Board. That will allow the company to advance through the final licensing and permitting stage for its Back River gold mine project.

The NIRB’s project certificate for the Back River mining project comes with 94 terms and conditions the company must follow.

But, with this certificate secured, other licences and permits for the project, including water licences to be issued by the Nunavut Water Board, will likely fall into place quickly.

All this comes less than two weeks after the federal government said the Back River project should go ahead..

By paying $2.65 per share, Zhaojin International has invested $66.1 million, which gives it about 10 per cent ownership of Sabina. It will also get a seat on Sabina’s board.

Sabina’s CEO and president, Bruce McLeod, called Zhaojin International a “strategic investor.”

The injection of money from China puts Sabina, which has about $38 million, about a quarter of the way towards building its $400-million-plus mine project complex.

Zhaojin International is a subsidiary of Zhaojin Mining Industry Co. Ltd., a leading Chinese gold producer and one of China’s largest gold smelting companies.

Zhaojin wants to double its production base within the next five to ten years through investments in international operations, said a news release on the deal with Sabina.

“Zhaojin’s investment represents a significant milestone for Sabina and is a strong endorsement of the work completed to date at our world class Back River project,” MacLeod said in the release.

“This financing with Zhaojin provides Sabina with a cornerstone investor that has financial and technical resources to assist us in advancing the project to production. With this capital in hand, we are currently working on finalizing plans and budgets for 2018 which will focus on de-risking the project with initial pre-construction activities as well as furthering exploration activities.”

Sabina’s plans for Back River—which were first rejected by Nunavut regulators due to concerns over impacts on caribou—include a chain of open pit and underground mines at its Goose property.

The pits are expected to be operational for at least 10 years and would involve filling, damming or draining lakes and streams, and building a 157-kilometre road from the mine to a seasonal port and tank farm at Bathurst Inlet, about 120 km south of Cambridge Bay on the mainland.

After an initial investment of $415 million, Sabina hopes to produce about 200,000 ounces of gold per year.

As for its gold reserves, these could increase. This past October, Sabina also reported positive results from its 2017 drilling program.

In connection with the financing deal, Sabina and Zhaojin International also signed a shareholder agreement that could allow Zhaojin International to increase its shareholding to up to 19.9 per cent of the common shares, providing up to 33 per cent financing, subject to certain terms and conditions, Sabina said.

If its equity in the project increases, Shaojin will be able to appoint a second director to Sabina’s board.

Sabina’s feasibility study said the Back River project has the potential to produce roughly 200,000 ounces of gold a year for about 11 years, with a rapid payback of 2.9 years for the construction.

A 2015 feasibility study, based on a larger scope, had calculated the initial capital cost of the project at $695 million, with another $539 million needed to sustain operations.

Sabina then looked at a smaller project, shedding a portion of the project to keep startup costs lower.

(0) Comments