More tit-for-tat accusations emerge between Inuit org and Nunavut mine

“I don’t want this to be a pissing match, because quite honestly, we need to be working together to get this IIBA implemented properly”

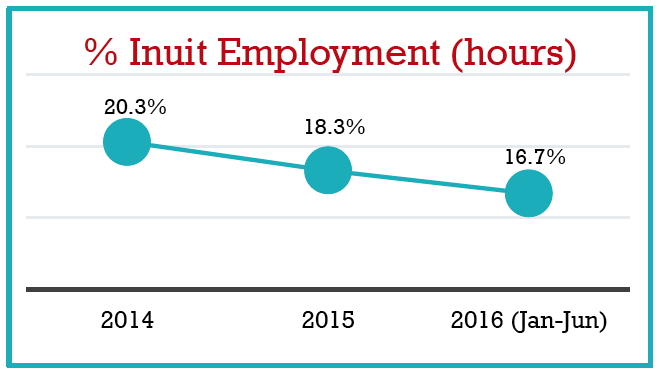

A graphic pulled from the QIA’s three-year review of the Mary River iron mine Inuit Impact and Benefits Agreement which appears to show dwindling Inuit employment at the north Baffin mine.

Baffinland Iron Mines’ Milne Inlet port on Baffin Island’s northeast coast, which services the iron mine, about 100 kms away by tote road. (FILE PHOTO)

Baffinland Iron Mines Corp. has not lived up to an impact and benefit agreement with the Qikiqtani Inuit Association, according to a three-year agreement review presented at the QIA’s annual general meeting in Iqaluit Oct. 6.

“In general, since its signing in 2013, the IIBA has not been implemented in a manner that maximizes benefits to Inuit, Inuit firms and affected communities,” the report says.

To a large extent, QIA blames those delays—and a host of “lost benefits” such as jobs, advancement and Inuit company contracts—on Baffinland, which operates the Mary River iron mine in North Baffin.

The QIA’s report pulls no punches. It says the reasons for the shortcomings are threefold, including, “a general lack of effort by Baffinland to participate in implementation activities and to share the information required to do so effectively.”

The report says, for example, that “to date, almost none of the $2 million guaranteed for Inuit education and training has been spent by Baffinland.”

By neglecting training and education programs, the company has fallen short of hiring targets and potential advancement for low-level Inuit employees, the report says.

The “minimum Inuit employment goal” for Baffinland was 25 per cent of the workforce but instead, Inuit employment has steadily decreased since 2013, the report says: to 16.7 per cent for the first half of 2016 compared to 20.3 per cent in 2014.

But a Baffinland spokesperson, who only got a copy of the QIA’s review from Nunatsiaq News Oct. 6, said the company was surprised by some of the report’s contents and asked to clarify a few things.

“I don’t want this to be a pissing match because quite honestly, we need to be working together to get this IIBA implemented properly. Because without this IIBA, and without this project, neither party has much,” said Todd Burlingame, from Baffinland’s Toronto head office Oct. 6.

Burlingame, Baffinland’s vice president for sustainable development, said a committee, made up of both Baffinland and QIA representatives, is responsible for creating and implementing education and training programs.

While the QIA report implies Baffinland has withheld millions in training money, that’s not the case, Burlingame said. Baffinland has made money available, but the committee tasked with spending it hasn’t done so.

Both parties need to work toward making that committee function properly, he said.

“We have to go back to the mandate of these things, come up with a budget and make sure people have administrative support as well as the resources earmarked to sit on these committees and get them working, because right now they aren’t,” he said.

Burlingame later emailed a written statement from head office saying the spirit and intent of an IIBA is for “a collaborative approach,” and that “while both parties have failed to fully meet their commitments, Baffinland remains committed to building a true partnership.”

The statement said the company has paid the QIA “more than $41 million” so far and invested “tens of thousands of person hours” on the IIBA’s implementation.

“Baffinland is disappointed that the QIA have chosen to release misleading and inaccurate information and we will be seeking for them to correct the inaccuracies contained within their Mary River Project Inuit Impact and Benefit Agreement Three Year Review,” Baffinland’s statement said.

The political posturing and mutual finger-pointing is indicative of how the relationship between the mining company and the designated Inuit organization has lately deteriorated.

That relationship has been further strained by a royalty dispute that came to light last month.

The QIA is alleging that Baffinland owes them $6.25 million in advance royalties, plus interest, that Inuit were supposed to have been paid, also under the agreed upon benefits and impact agreement.

Baffinland disagrees and so the facts of the case have been handed over to a three-person arbitration panel.

Burlingame said Oct. 6 that the company attempted to negotiate a mediated settlement with QIA over the royalty issue but that the Inuit organization chose instead to go straight to arbitration.

When asked about those attempted negotiations, Burlingame said commenting in the media would be improper now that arbitration is underway.

The arbitration panel hopes to hold a two-day hearing at the end of October in Vancouver and attempt to reach a decision on the royalty issue by Dec. 24.

While the QIA’s IIBA review often singles out Baffinland for falling short on its commitments, the Inuit body does acknowledge its own shortcomings saying, “QIA underestimated the complexity of IIBA implementation and the degree to which the organization would be expected to lead it.”

That resulted in “unforeseen delays,” and miscommunication, the report says, both of which were further hampered by absent policies on who was supposed to do what under the IIBA, organizational capacity at both Baffinland and QIA, “ambiguous language,” and ongoing project changes proposed by Baffinland.

But the QIA says it is committed to ensuring Inuit benefit from the huge iron mining project, a goal Baffinland says it shares.

“Inuit still face a number of barriers that prevent us from maximizing the benefits and opportunities of having the Mary River Project operate on Inuit Owned Land,” wrote QIA President PJ Akeeagok, in the IIBA review.

“QIA will continue to fight to protect Inuit rights and values by holding ourselves and Baffinland accountable to implementing and improving our IIBA.”

The Mary River mine, which boasts one of the richest iron ore deposits in the world, is located south of Pond Inlet and north of Igloolik.

The mine is currently operating under its Early Revenue Phase which consists of mining roughly 4.2 million tonnes of iron ore per year and shipping it to European markets during the open water season.

In order to maximize revenues during a period of slumping commodity prices, the company is hoping to expand its annual production, increase its shipping to 10 months of the year with ice-breaking and possibly build a railway to Milne Inlet.

But that project expansion is still mired in Nunavut’s regulatory approval process.

(0) Comments